History of Sri lanka Banking System

When Sri Lanka or then known as Ceylon was was under the reign of the Sinhalese kings and even the Portuguese(1505-1656) and Dutch (1656-1796), banks and banking were still alien to Sri Lankan culture.it was only during the British colony(1802-1948) that Banking was introduce to Sri Lanka.Two years after independence The Central Bank of Sri Lanka was established in 1950 for maintain an active monitory policy regime and a dynamic financial sector to support and promote economic growth.

History of Currency in Sri Lanka

The Sri Lankan Rupee is the unit of currency used in Sri Lanka, symbolized by Rs, or SLRS to distinguish it from other Rupees.The other rupee is sub devided into 100 cents.

The British pound became ceylon,s official currency in 1825, replacing in the rixdollar Ceylon, at a rate of a found =13 1/3 Rixdollars,and British Silver coins became legal tender.

Sri Lankas Currency-use can be divided into following periods.

- Anuradhapura Era

- Polonnaruwa to Kotte Era

- Kandy Era

- Colonial Era

- Post-independence period since Establishment of the Central Bank of Ceylon

Coins used in Anuradhapura Era

There are many information about trade and currency use during the anuradhapura Era.Many records suggest that the production and distribution of coins were done systematically.At the time, the director in charge of coins production was known as ''Rupakada''. The following coins was used by Anuradhapura Era.

- Kahapana

- Swasthika coins

- maneless lion coins

- Lakshmi plaques

- Kahawanu or Lankeshwara Coins

- Foreign coin

Coins used Polonnaruwa to Kotte Era

Kings of Chola dynasty that rule from 1017-1070 A.D, issued a ''Kahawanu'' that was minted in the last half of the Anuradhapura Era.It was made of copper.A unique characteristic of these coins was that each one bore the name of the king in power at the time of its production.The following coins was used in polonnaruwa Era.

- Massa Coins

- Dambadeni coins

- Lion Coins

- Cetu Coins

Coins used in Kandy Era

Kandy was the last capital of the sinhala monarchy.1815 was sign transferring Sri Lanka's autonomy to the British.The portuguese and Dutch eshtablished in the maitime areas during Kandyam Era.According to historical text a few different types of currency were in use during this Era.

- Koku coins

- Dambadeni kasi

- salli

- Indian Waragama

- Tuttu

- panama

- Tangama

Colonial Era

Sri Lanka was was colonized by the portuguese, the Dutch and the English respectively.

Portuguese Period - Portuguese turned their attentive eye towords the prosperous trade center that was Sri Lanka.They took control of the coastal areas.

Coins used in Portuguese Period

- Malacca

- Gini Massa

- coins of saints

Dutch Period-After Dutch acquired the Portuguese fort, the dutch made a treaty with king Rajasinghe 2.section 14 of the treaty contains a multitude of rules regarding use of money.unless sanctioned by the king or the Dutch government, the acts of printing,minting counterfeit coins or circulation was deemed illegal.

British Period-There are two types of coins used for transactions in Sri Lanka.The first was a gold coin minted in Madras known as 'Tharaka pagodi' or the Start pagodi. The second types of coins was a copper one.

Subsidiary Currency Notes

Under the provisions of the emergency power acts.1939 and 1940 the board of currency was authorized to issue denominations below one rupee to meet the shortage of coins.The board commissioners issued subsidiary notes for the value of 5 cents, 10 cents, 25 cents, and 1 rupee.of these notes, carried imprints of postage stamps of 2 cents and 3 cents.

in addition to these subsidiary notes, the Board of Commissioners issued notes worth 1 rupee, 2 rupees, 5 rupees, 5 rupees, 10 rupees, 50 rupees, 100 rupees, 500 rupees, 1000 rupees.

Coins in circulation

The central bank of Sri Lanka has the sole right and authority to issue currency in Sri Lanka as stipulated in the monitory Act No.58 of 1949.

The denominations of coins mostly in circulation are;

Rs. 10 | Rs. 5 | Rs. 2 |

| |  |  |

Rs. 1 | 50 Cents | 25 Cents |

|  |  |

10 Cents | 5 Cents | 2 Cents |

|  |  |

1 Cent | ||

|

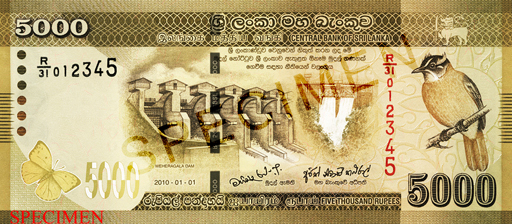

Current Notes Series

After establishment of the Central Bank of Sri Lanka in 1950, eleven note series have been issued under eleven themes.